“Wealth Sherpa helps wealth managers nurture more profitable relationships through automation.”

Wealth Sherpa was borne out of seeing the time wastage before and after meetings with clients during my time working as an analyst/paraplanner at St James Place. The end product was a technical success, bringing down the process time of suitability letters from an hour to just a couple of minutes, but a commercial failure which I learned many lessons from.

The Idea Maze

My first day at Imperial College I had a meeting with the career service, which is a conversation that would shape the rest of my life.

“So if you could do anything, what would you do?”

“Well I want to leave here to be a quant and ‘earn my stripes’, but my dream has always been to start a tech company.”

“So why not take the straightest path?”

Over the next year I soaked up as much from lectures and pitch evenings in the Imperial Enterprise Lab as I did my studies in the Business School. My first idea for the product was to portfolio analytics as existing products like FE still required a lot of manual usage. After some customer discovery interviews I decided not only was this an increasingly crowded space but also wasn’t seen as too much of a pain point. I then pivoted to the hidden friction of suitability letters, which wasted a lot of cumulative time and had zero scalability between clients unlike portfolio analytics.

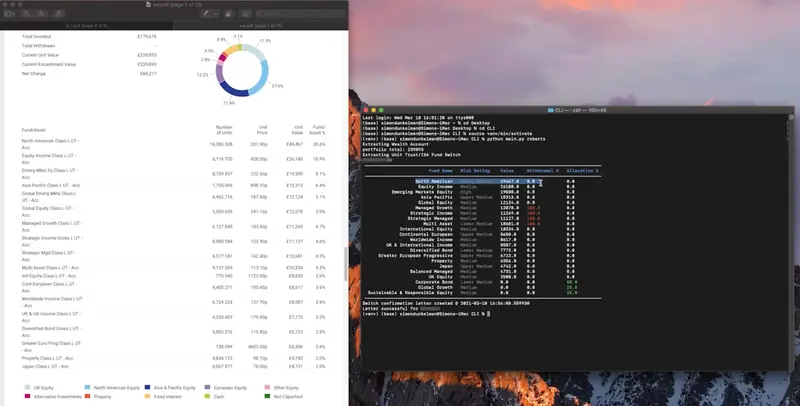

Between early 2020 and my graduation in September I started building the PDF extraction and document generation tool. This took many iterations to get to our target accuracy as the fund transfer PDFs were highly variable between investment vehicle types, with the final solution requiring image segmentation (opencv2) and OCR.

After graduation I began building this from a proof-of-concept into a startup. I pitched the idea to the partner at St James Place that I previously worked for and secured some small initial investment for development costs. I also had my first foray into brand design (thanks to the mentorship of Tom Woodnutt) which years later I now consider my second strongest skill set after software development (side note: the sherpa lives on in Account Sherpa which I designed and built for my accountant).

Lesson

=> Mixing investors and early customers is VERY delicate. You need to be extra explicit in defining boundaries and expectations at the beginning to avoid misunderstandings later.

MVP

With time pressing on and the ReactJS frontend of my app not yet finished, I wanted to begin testing and validating the core document engine. I began selling the service as I had as a contractor to my investors practise, generating documents using a CLI version of the app and checking them myself to QA the result. In retrospect this was a good idea but I used the exercise as too much of a validation that the tech worked and not enough of the validity of the products demand - I should have scaled this manual service to more practises to learn how much of a pressing issue suitability letters were.

During this time I was juggling development and customer outreach trying to contact as many of the ~11,000 SJP partners I could to find customers for once I launched. First it was the LinkedIn connections, then it was emails and then in a final desperation I scraped the “Find an Adviser” interactive map to start calling as many as I could. This was my first experience with cold outreach and looking back I couldn’t have made more mistakes if I tried. After sending yet another email into the void I remember getting a response back from one of my previous emails: “Can we talk on the phone?“. I was elated. I called him, only to find out that due to using my internal SJP address and the way I had worded it, he (and likely many others) had assumed this was test from SJP in avoiding phishing links from hacked emails.

Towards the end of the year as my cash ran ever shorter I went all-in getting the first version ready for production. I hired a React developer on Upwork to help increase capacity whilst I fixed the parts of the backend that weren’t ready for production yet. Bearing in mind this also coincided with the second COVID lockdowns of the UK, my time in a dingy basement flat in Putney were about as isolating an experience I think is possible for an founder. It was an intensity I think few have experienced. I was at my desk by 9am and would finish work around 1-2am and the closest I got to leaving the house was answering the door for the food delivery guy, driven by pure adrenaline at the thought of failing (or dreams of succeeding). The last weeks of December 2020 I thought “just one more push to launch this”, repeated over consecutive weeks blinded by the fog of never having built a production app before. I worked an average of 114 hours a week and subsequently, and very obviously, suffered a breakdown of extreme burnout. I went home for a while and returned a couple of months later - there were tasks on my whiteboard that had taken me a week to complete that I had intended to finish in a morning!

Lesson

=> More of a lesson about myself, but with my natural intensity I was always going to suffer extreme burnout at some stage. This wouldn't be the last time I sacrificed health for work, but the experience of Wealth Sherpa was the inflection point that lead to me maturing where now I can work sustainably for the marathon, not just the sprints.

Lesson

=> In this project and in every one since I have truly learned the value of accurate time management. I think Engineers are more prone than any other team member to overconfidence/underestimation with also the greatest impact when estimates are not realistic.

Launch

With the app now finally working with first customers, I met with the director of Business Development for SJP to discuss use of the app and whether we could push this out further to advisers. He then set me up with a member of the technology team, who laid out the due dilligence process for becoming approved by SJP. It was ~80 questions and came with the heads up that a firm who had 7 figure ARR was still working through the process after 12 months. I quickly realised there was no chance I could launch my app in its existing SaaS web app form. I then had the not-so-genius idea of converting my app to an entirely local Electron desktop app, handling all processing on the users machine. Not surprisingly whilst this was fine on my own macbook the performance was awful on the sorts of Windows machines that plague financial services.

During this time sales were also lacking as I had made another critical error in that I over-extrapolated early customer behaviour. The partners that my investor had introduced me to were similar to himself in that they were incredibly active in updating portfolio allocations, leading to the suitability letters we automated being a hair on fire problem. It turns out that this level of re-allocation was less common across SJP, with some advisers placing clients in a pre-defined portfolio allocation and then almost never touching it again.

Outcome

Out of cash and prospects of any success dwindling I decided to chalk up Wealth Sherpa as the intense, rewarding and thoroughly educating first experience in founding that it was. One of the things I have since looked for in a co-founder is the scar of spending too much time on a project for it to fail, as it breeds a need for rigorous and efficient validation in future projects like nothing else. I was lucky that most of the time working on Wealth Sherpa was during my Masters which softened the opportunity cost, but if it taught me one thing (of many) it is that a startup is a science experiment with a timer over your head, and there is truly no alternative to “running into the spike”.

Lesson

=> It cannot take 18 months to realise whether you have flipped a heads or a tails on an idea. If you must fail, FAIL FAST!